lincoln ne restaurant sales tax

The average cumulative sales tax rate in Lincoln Nebraska is 688. As far as sales tax goes the zip code with the.

6029 Old Farm Cir Lincoln NE 68512.

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

. To learn more see a full list of taxable and tax-exempt items in Nebraska. Businesses for Sale in 400 categories and 240 countries. The Nebraska state sales and use tax rate is 55 055.

Tax Services For Sale In Lincoln Nebraska. The Lincoln sales tax rate is 175. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. SOLD DEC 15 2021. There is no applicable county tax or special tax.

Nebraska City NE Sales Tax Rate. Larkspur California United States. Recently Sold Homes Near 841 Norwood Dr.

An Osborn Construction Inc crew begins replacing the sanitary sewer system. Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling 175. Rates include state county and city taxes.

The minimum combined 2022 sales tax rate for Lincoln County Nebraska is. Did South Dakota v. The Nebraska sales tax rate is 55 as of 2022 with some cities and counties adding a local sales tax on top of the NE state sales tax.

Are there exemptions for the City of Lincoln Restaurant Bar Occupation Tax. NE Rates Calculator Table. 000 sales tax 10000 total.

Lincoln is located within Lancaster County Nebraska. State Of Nebraska Sales Tax in Lincoln NE. 2020 rates included for use while preparing your income tax deduction.

North Platte NE. Revenue will be generated from the increase starting October 1 and once in place will bump up Lincolns sales tax rate from the current 7 percent or. What is the sales tax rate in Lincoln Nebraska.

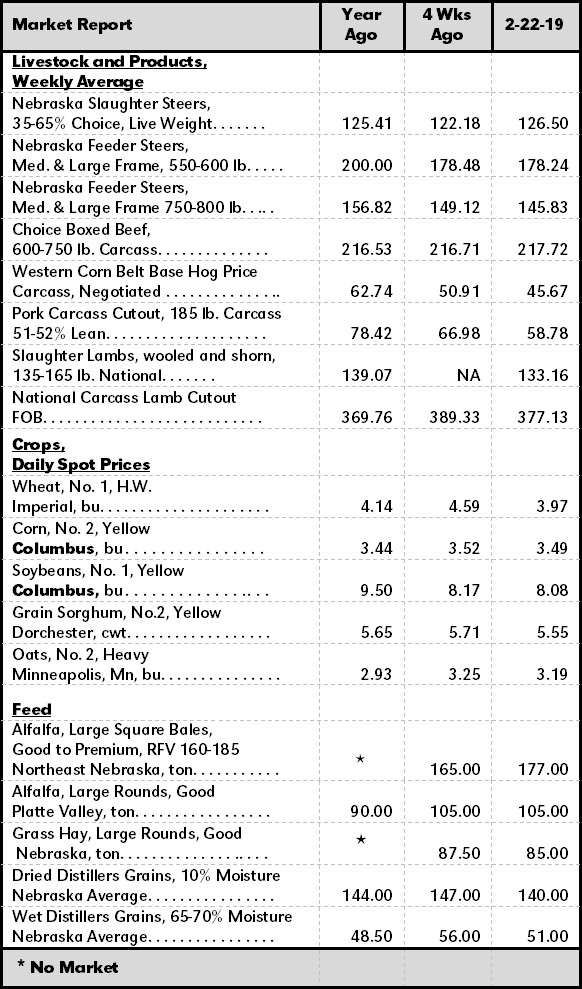

Funds will be removed from your account the next working day. Occupation tax shall be imposed on the gross receipts resulting from the sales of food within the corporate limits of the City of Lincoln which are subject to the sales and use tax imposed by the State of Nebraska Revenue Act of 1967. It is not intended to answer all questions which may arise but is intended to enable a person to become familiar with the sales tax provisions affecting bars taverns and restaurants.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Groceries are exempt from the Lincoln and Nebraska state sales taxes. Exemptions to the Nebraska sales tax will vary by state.

The Lincoln Sales Tax is collected by the merchant on all qualifying sales made within Lincoln. Nearby homes similar to 841 Norwood Dr have recently sold between 225K to 430K at an average of 145 per square foot. Phoenix Arizona United States.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. One of a suite of free online calculators provided by the team at iCalculator. By NANCY HICKS Lincoln Journal Star.

Norfolk NE Sales Tax Rate. Has impacted many state nexus laws and sales. State of Nebraska Unemployment Insurance Tax.

This 3-bedroom 1 bathroom home comes with plenty of space an updated k. SOLD APR 19 2022. On September 3 Mayor Jean Stothert announced that the citys Finance Department has been directed to forgive late fees on restaurant.

Lincoln NE Sales Tax Rate. Includes the 050 transit county sales and use tax. Juice Bar For Sale.

3212 Vine St Lincoln NE 68503 189000 MLS 22212397 Welcome to 3212 Vine. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725.

283000 Last Sold Price. The latest sales tax rates for cities in Nebraska NE state. While Nebraskas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

This includes the sales tax rates on the state county city and special levels. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. For tax rates in other cities see Nebraska sales taxes by city and county.

The County sales tax rate is 0. Any company may use this online payment system to pay any of the following Occupation Taxes. Lincoln NE 68509.

3 beds 1 bath 1288 sq. Within Lincoln there are around 28 zip codes with the most populous zip code being 68516. 1075 Buyers Online Now.

You can print a 725 sales tax table here. 950 sales tax 10950 total. Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect.

Lincoln collects a 175 local sales tax the. This rate includes any state county city and local sales taxes. It may look like a tax on a tax but its not.

McCook NE Sales Tax Rate. This is the total of state and county sales tax rates. Name A - Z Sponsored Links.

The 2018 United States Supreme Court decision in South Dakota v. Showing 1-1 of 1. The current total local sales tax rate in Fremont NE is 7000.

If you have any questions please call the Lincoln City Treasurer Monday thru Friday from 800 am to 430 pm at 402 441-7457 or use our email. The Nebraska state sales tax rate is currently. The 1 Business for Sale Marketplace.

Fremont NE Sales Tax Rate. Nebraska and local option sales tax by bars taverns and restaurants. Sales and Use Tax Rates Effective October 1 2020.

The Nebraska sales tax rate is currently 55. The Lincoln County sales tax rate is. The December 2020 total local sales tax rate was also 7000.

100 of consumer products. 3-2007 Supersedes 6-371-1999 Rev. Payments will be processed on the first working day after the 25th of the month.

2020 rates included for use while preparing your income tax deduction. This page describes the taxability of food and meals in Nebraska including catering and grocery food. Insurance State Government 402 471-9839.

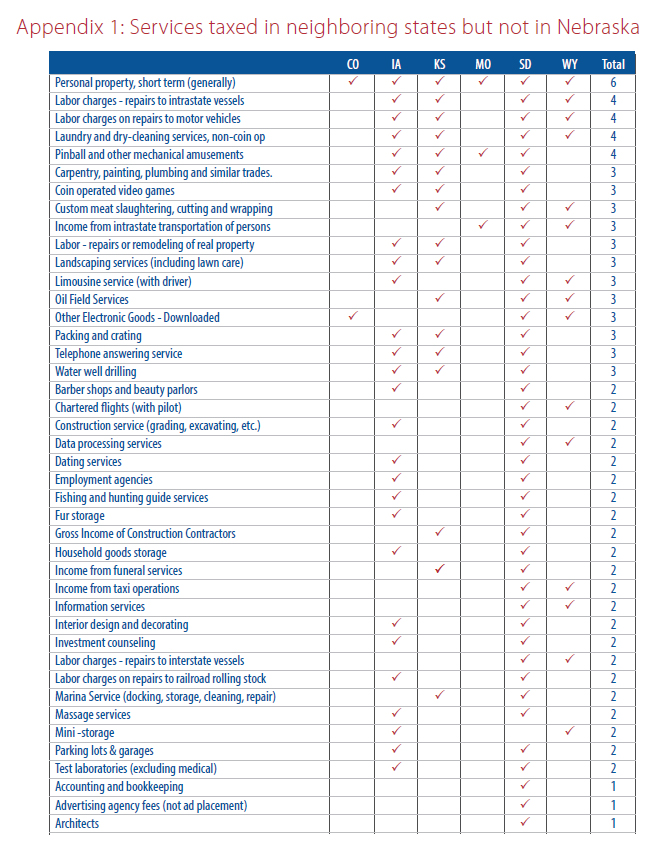

2019 Nebraska Property Tax School Funding Issues Agricultural Economics

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

How To Register For A Sales Tax Permit Taxjar

Nebraska Sales Tax Small Business Guide Truic

Dining Out In Lincoln A Taste Of Malaysia Opens Its Doors In Lincoln Dining Journalstar Com

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

Online Filing For Nebraska Business Taxes Nebraska Department Of Revenue

Unicameral Narrowly Passes Biggest Tax Cut We Ve Done

A Guide To Omaha And Nebraska Taxes

Pandemic Will End Nebraska Club S 66 Year Run In Lincoln Dining Journalstar Com